Beginners Guides

Discover Savings with Property Finder’s Mortgage Calculator

Did you know that using a mortgage calculator can help you save thousands of dollars when buying a home? Property Finder’s Mortgage Calculator is a powerful tool that can assist you in making smart financial decisions and planning for your future.

With its user-friendly interface and comprehensive calculations, Property Finder’s Mortgage Calculator empowers you to estimate your mortgage payments and determine what you can comfortably afford. By inputting your loan details, such as the price of the home, down payment amount, and loan term, you can get an instant estimate of your monthly payment. This valuable information allows you to budget effectively and avoid any financial strain down the line.

Key Takeaways:

- Property Finder’s Mortgage Calculator is a powerful tool for estimating mortgage payments and planning finances.

- By inputting loan details, such as the price of the home and down payment amount, users can get instant estimates of their monthly payments.

- Understanding your affordability and budgeting effectively is crucial when purchasing a home.

- Property Finder’s Mortgage Calculator provides a user-friendly interface and comprehensive calculations to simplify the home buying process.

- Make informed financial decisions with Property Finder’s Mortgage Calculator and secure your dream home while maintaining financial stability.

Mortgage Calculator

How Does Property Finder’s Mortgage Calculator Work?

Property Finder’s Mortgage Calculator is a powerful tool that simplifies the process of estimating mortgage payments and planning finances. It works by taking into account various factors that influence mortgage payments, giving users a comprehensive understanding of their financial commitment.

Users can input key details such as the price of the home, down payment amount, loan term, and interest rate into Property Finder’s Mortgage Calculator. By considering these variables, the calculator provides an estimated monthly payment, allowing individuals to make informed decisions about their homeownership journey.

The calculator also goes the extra mile by factoring in additional costs like property taxes, insurance, and HOA fees. It provides a comprehensive breakdown of the total monthly payment, enabling users to budget effectively and avoid any surprises later on.

With Property Finder’s Mortgage Calculator, users are empowered to explore different scenarios and adjust their loan details to match their specific situation. This level of customization ensures a personalized and accurate estimation of mortgage payments.

By making use of this intuitive tool, individuals can gain clarity about the financial implications of homeownership and make well-informed decisions. Property Finder’s Mortgage Calculator is an indispensable resource for anyone looking to navigate the complexities of the housing market with confidence.

The Importance of Using a Mortgage Calculator

Using a mortgage calculator, like Property Finder’s Mortgage Calculator, is crucial for prospective homebuyers. It allows them to have a clear understanding of their financial situation and affordability before committing to a mortgage. By inputting various loan details, users can see how different factors, such as down payment amount and loan term, affect their monthly payment. This knowledge empowers them to make informed decisions and avoid potential financial strain in the future.

When considering a mortgage, it’s essential to have a comprehensive understanding of the financial implications. Without a mortgage calculator, individuals may be left guessing their monthly payment based on assumptions or unreliable estimates. This can lead to financial uncertainty and potentially taking on more debt than they can comfortably afford.

Plan Ahead and Set Realistic Budgets

By using a mortgage calculator, prospective homebuyers can plan ahead and set realistic budgets. They can enter the purchase price, loan term, and interest rate to calculate their monthly payment. Additionally, they can experiment with different down payment amounts to see how it impacts their affordability. This level of detail allows individuals to have a clearer picture of what they can comfortably afford.

“Using a mortgage calculator was eye-opening. It helped me understand the financial implications of different loan terms and down payment amounts. With this information, I was able to set a realistic budget and confidently move forward with my home purchase.” – Sarah Johnson, Homebuyer

Compare Different Scenarios

Another significant advantage of using a mortgage calculator is the ability to compare different scenarios. Users can input various loan details and see how different factors impact their monthly payment. For example, they can compare the financial implications of a 15-year fixed-rate loan versus a 30-year fixed-rate loan.

By experimenting with different loan terms, interest rates, and down payment amounts, individuals can make informed decisions about their mortgage options. This level of flexibility and customization empowers them to choose the scenario that aligns best with their financial goals and long-term plans.

Avoid Surprises and Financial Strain

One of the main advantages of a mortgage calculator is its ability to help individuals avoid surprises and financial strain. By calculating the monthly payment and understanding the long-term financial commitment, individuals can better plan for future expenses and avoid potential strain on their budget.

For example, using a mortgage calculator can help individuals anticipate the impact of property taxes and insurance costs on their monthly payment. By factoring in these additional expenses, individuals can make informed decisions about their home purchase and budget accordingly.

In summary, the importance of using a mortgage calculator cannot be overstated. It provides individuals with the necessary tools and information to make informed decisions about their home purchase and financial planning. By using Property Finder’s Mortgage Calculator, prospective homebuyers can have confidence in their affordability and avoid potential financial strain in the future.

Benefits of Using Property Finder’s Mortgage Calculator

Property Finder’s Mortgage Calculator offers several benefits to users. Firstly, it provides an easy-to-use interface that allows individuals to input their loan details and get an instant estimate of their monthly payment. This saves time and effort compared to manual calculations. Additionally, the calculator takes into account additional costs like property taxes and insurance, giving users a more accurate understanding of their total monthly payment.

The calculator also provides users the opportunity to customize their mortgage details by making assumptions for fields they may not know yet. This flexibility allows individuals to explore different scenarios and plan their finances accordingly. Whether they want to adjust the down payment amount or explore different loan terms, Property Finder’s Mortgage Calculator helps users make informed decisions about their home purchase.

Overall, Property Finder’s Mortgage Calculator simplifies the home buying process and helps users make informed financial decisions. By providing a comprehensive breakdown of the monthly payment, including additional costs, users can have a clear understanding of their affordability and plan their budget accordingly. Whether someone is a first-time homebuyer or looking to refinance, Property Finder’s Mortgage Calculator is a valuable tool for anyone in need of accurate and accessible mortgage calculations.

“Using Property Finder’s Mortgage Calculator saved me so much time and effort. I was able to quickly get an estimate of my monthly payment and understand the impact of different loan details. It simplified the home buying process for me and allowed me to make informed decisions.” – Sarah, Homebuyer

Factors Affecting Mortgage Payments

When it comes to mortgage payments, there are several factors that can influence the amount you’ll need to pay each month. Understanding these factors is essential for effective financial planning. Property Finder’s Mortgage Calculator takes all of these variables into account to provide users with an accurate estimation of their monthly payment.

One of the primary factors that affects mortgage payments is the price of the home. The higher the price, the higher the monthly payment will typically be. Similarly, the down payment amount also plays a significant role. A larger down payment can reduce the loan amount and subsequently lower the monthly payment.

The loan term, or the length of time you have to repay the mortgage, is another crucial factor. Generally, shorter loan terms result in higher monthly payments but lower total interest paid over the life of the loan. In contrast, longer loan terms often come with lower monthly payments but incur more interest over time.

The interest rate is yet another critical factor in mortgage payments. Higher interest rates mean higher monthly payments, while lower rates can result in more manageable payments.

In addition to the above factors, property taxes, insurance premiums, and HOA fees can also impact monthly mortgage payments. These expenses vary depending on the location and type of property. Property Finder’s Mortgage Calculator takes these variables into consideration to provide users with a comprehensive breakdown of their monthly payment.

By understanding how these factors affect mortgage payments, individuals can make informed decisions about their loan details and plan their finances accordingly. Property Finder’s Mortgage Calculator offers a user-friendly interface that simplifies the process, allowing users to input their specific information and obtain an accurate estimation of their monthly payment.

With a clear understanding of these factors, individuals can confidently navigate the home buying process and make educated decisions about their financial future.

How to Use Property Finder’s Mortgage Calculator

Using Property Finder’s Mortgage Calculator is a simple and straightforward process that can help individuals make informed decisions about their home purchase and financial planning. By inputting the necessary details, users can get an accurate estimation of their monthly payment and have a clearer understanding of their financial situation. Here is a step-by-step guide on how to use the calculator:

- Begin by accessing Property Finder’s Mortgage Calculator on the website.

- Input the price of the home in the designated field. This should reflect the total cost of the property you are looking to purchase.

- Next, enter the down payment amount in the respective field. This is the initial upfront payment made towards the home purchase.

- Specify the desired loan term in years. This represents the length of time in which you plan to repay your mortgage.

- Enter the interest rate associated with the loan. This is the annual percentage rate charged by the lender.

- If applicable, input any additional details such as property taxes, insurance, and HOA fees in the corresponding fields.

- Click on the “Calculate” button to generate the estimated monthly payment.

Once you have completed these steps, the calculator will provide you with an estimation of your monthly payment. This will include a complete breakdown of the principal, interest, taxes, insurance, and any other additional costs associated with the mortgage. With this information in hand, you can make informed decisions about your home purchase and financial planning.

Maximizing the Benefits

To maximize the benefits of using Property Finder’s Mortgage Calculator, consider adjusting the loan details to fit your specific scenario:

- Experiment with different down payment amounts to see how it impacts your monthly payment. A higher down payment can lead to a lower monthly payment and potentially help you avoid additional costs like private mortgage insurance (PMI).

- Explore different loan terms to understand how they affect your monthly payment. Longer loan terms often have lower monthly payments but may result in more interest paid over the life of the loan. Conversely, shorter loan terms may lead to higher monthly payments but can help you pay off the loan quicker.

- Adjust the interest rate to see how it impacts your monthly payment. Understanding the relationship between the interest rate and your payment can help you evaluate different loan options and find the most favorable terms.

By utilizing the various features and adjusting the loan details, you can get a more accurate estimate and gain valuable insights into your financial situation.

“The Property Finder’s Mortgage Calculator is a user-friendly tool that empowers individuals to make well-informed decisions about their home purchase and financial planning.”

Don’t let uncertainty be a roadblock in your homebuying journey. Take advantage of Property Finder’s Mortgage Calculator to gain a better understanding of your financial situation and plan your future with confidence.

| Benefits of Using Property Finder’s Mortgage Calculator: |

|---|

| 1. Quick and easy estimation of monthly payments |

| 2. Comprehensive breakdown of principal, interest, taxes, insurance, and additional costs |

| 3. Customizable loan details to fit your specific scenario |

| 4. Helps in making informed decisions about your home purchase and financial planning |

Understanding Mortgage Financing Options

When navigating the world of mortgage financing, it’s crucial to have a clear understanding of the various options available to you. Property Finder’s Mortgage Calculator can assist you in exploring different mortgage financing options, making it easier to choose the right fit for your needs.

Let’s take a closer look at some common mortgage financing options:

1. Conventional Loans

Conventional loans are popular mortgage options that are not insured or guaranteed by the government. They typically require a higher credit score and down payment compared to other loan types. However, conventional loans offer flexibility and competitive interest rates.

2. FHA Loans

FHA loans are backed by the Federal Housing Administration (FHA) and are designed to assist borrowers with lower credit scores and down payments. These loans often have more flexible qualification requirements and can be an excellent option for first-time homebuyers.

3. VA Loans

VA loans are exclusively available to military service members, veterans, and their eligible spouses. These loans are guaranteed by the Department of Veterans Affairs and offer favorable terms such as lower interest rates, no down payment requirements, and no private mortgage insurance (PMI).

4. USDA Loans

USDA loans, backed by the U.S. Department of Agriculture, are intended for individuals purchasing properties in eligible rural areas. These loans often have competitive interest rates and may require no down payment.

5. Jumbo Loans

Jumbo loans are used for financing high-value properties that exceed the limits set by conventional loan programs. These loans have larger down payment requirements and stricter qualification standards but can provide funding for luxury homes or properties in high-cost areas.

Remember, each mortgage financing option comes with its own set of requirements, rates, and terms. By understanding the different loan options available, you can make informed decisions and select the financing option that aligns with your financial goals and circumstances.

Property Finder’s Mortgage Calculator allows you to explore different loan scenarios to better understand how each financing option impacts your monthly payment. This valuable tool empowers you to make well-informed decisions based on your specific needs and financial capabilities.

Whether you’re considering a conventional loan, exploring government-backed options, or looking into jumbo loans, understanding your mortgage financing options is essential for a successful homebuying journey. Take advantage of Property Finder’s Mortgage Calculator to gain the insights you need to make confident and informed decisions about your future home purchase.

Importance of Down Payment in Mortgage Calculations

The down payment amount is a crucial factor in mortgage calculations. By understanding its significance, individuals can make informed decisions about their finances and the affordability of their dream home. A higher down payment can result in a lower monthly payment and may even help avoid additional costs like private mortgage insurance (PMI).

With Property Finder’s Mortgage Calculator, users can input their desired down payment amount to see how it affects their monthly payment. This valuable tool provides a clear picture of the financial impact the down payment has on the overall mortgage. It allows individuals to explore different scenarios and determine the down payment amount that suits their budget and long-term goals.

By making a larger down payment, borrowers can reduce the principal loan amount, which in turn lowers the monthly payment. It also gives them the opportunity to build equity in their home faster, potentially leading to substantial savings over time. Additionally, a higher down payment may allow borrowers to secure a more favorable interest rate, resulting in further savings.

Property Finder’s Mortgage Calculator empowers individuals to make smart financial decisions by providing them with detailed and accurate calculations. It helps them understand the benefits of a larger down payment and encourages better financial planning.

By allocating more funds upfront as a down payment, buyers can enjoy the advantages of reduced monthly payments, potential interest savings, and quicker equity buildup.”

When planning to purchase a home, it’s essential to calculate mortgage affordability carefully. A higher down payment not only lowers the monthly payment but also reduces the overall mortgage amount, helping buyers save money in the long run.

By leveraging Property Finder’s Mortgage Calculator and understanding the importance of a substantial down payment, potential homebuyers can make informed financial decisions and secure a mortgage that aligns with their budget and savings goals.

Understanding Additional Costs in Mortgage Payments

When it comes to mortgage payments, it’s important to consider more than just the principal and interest. Additional costs such as property taxes, insurance, and HOA fees can significantly impact the total monthly payment. By understanding and planning for these expenses, individuals can have a more accurate understanding of their financial obligations and budget accordingly.

Property taxes are fees imposed by local governments based on the value of the property. They are typically paid on a yearly basis and can vary depending on the location and assessed value of the home. Including property taxes in the mortgage payment ensures that homeowners are setting aside the necessary funds for this recurring expense.

Insurance is another key factor to consider. Homeowners insurance provides financial protection in the event of damage or loss to the property. Lenders often require homeowners insurance as part of the mortgage agreement. Additionally, private mortgage insurance (PMI) may be required for buyers with a down payment less than 20% of the home’s value.

HOA fees, or homeowner association fees, are common for properties located within a community or development with shared amenities, such as a pool or clubhouse. These fees cover the maintenance, insurance, and management of these shared areas. Including HOA fees in the mortgage payment ensures that homeowners are prepared for these ongoing costs.

To help individuals understand the impact of these additional costs, Property Finder’s Mortgage Calculator takes them into account when calculating the estimated monthly payment. This comprehensive breakdown allows users to make more informed decisions about their budget and financial planning.

Being aware of and planning for these additional expenses is essential for a successful homeownership journey. By accurately estimating the total monthly payment, individuals can budget effectively and ensure they are prepared for all the costs associated with their mortgage.

Calculating Mortgage Interest and Insurance

When determining monthly mortgage payments, it is essential to consider both mortgage interest and insurance costs. Property Finder’s Mortgage Calculator takes into account these factors to provide users with a comprehensive estimation.

The interest rate is the annual cost borrowers pay to lenders for borrowing money, expressed as a percentage. It is a crucial component of mortgage calculations and directly impacts the monthly payment. By factoring in the interest rate, individuals can better understand the long-term financial implications of their mortgage.

In addition to interest, insurance costs play a significant role in mortgage payments. Private mortgage insurance (PMI) and homeowner’s insurance are additional expenses that borrowers need to consider. These insurance costs protect the lender and the homeowner in different ways.

“Mortgage interest and insurance are important factors to consider when planning your housing budget. By accurately calculating these costs, Property Finder’s Mortgage Calculator provides users with a more precise estimation of their monthly payment.”

By incorporating mortgage interest and insurance costs into the calculation, Property Finder’s Mortgage Calculator enables individuals to make informed decisions about their housing budget. This tool empowers users to tailor their mortgage details and consider the impact of interest rates and insurance expenses on their monthly payments.

Mortgage Interest

The interest rate is determined by various factors, including the borrower’s creditworthiness, market conditions, and loan term. It represents the additional cost incurred for borrowing money over a certain period. A higher interest rate will lead to higher monthly payments, while a lower interest rate will result in lower payments.

Understanding the mortgage interest rate is crucial for prospective homebuyers to evaluate their affordability and make sound financial decisions. Property Finder’s Mortgage Calculator allows users to input different interest rates to see how they affect their monthly payment, helping them choose the most suitable mortgage option.

Insurance Costs

In addition to interest, insurance costs are a necessary consideration in mortgage payments. Private mortgage insurance (PMI) is typically required for borrowers with a down payment less than 20%. This insurance protects the lender in case of default. Homeowner’s insurance, on the other hand, safeguards the homeowner in the event of damage or loss to the property.

Property Finder’s Mortgage Calculator considers these insurance costs when calculating the monthly payment. This holistic approach provides users with a more accurate estimation of their total housing expenses, ensuring they have a comprehensive understanding of their financial commitment.

| Interest Rate | Insurance Costs | Monthly Payment |

|---|---|---|

| 3.5% | $100 | $1,200 |

| 4.0% | $125 | $1,275 |

| 4.5% | $150 | $1,350 |

The table above illustrates how different interest rates and insurance costs can impact the monthly payment. As the interest rate and insurance costs increase, the monthly payment also increases. Property Finder’s Mortgage Calculator allows users to experiment with different scenarios and find the combination that works best for their financial situation.

By incorporating mortgage interest and insurance costs into the calculation, Property Finder’s Mortgage Calculator provides individuals with valuable insights into their monthly payment. This comprehensive estimation enables users to plan their finances effectively and make informed decisions about their mortgage.

Different Mortgage Loan Terms and Their Impact on Payments

When it comes to mortgage loans, understanding the different loan terms can have a significant impact on monthly payments. Property Finder’s Mortgage Calculator allows users to explore these loan terms and see how they affect their payment. By inputting the loan term details into the calculator, individuals can gain valuable insights into their mortgage options and make informed decisions.

Mortgage loan terms commonly include options such as 30-year fixed, 15-year fixed, and adjustable-rate mortgages (ARMs). Each of these terms has its own implications on monthly payments, and it’s important to understand how they work.

Longer loan terms, such as a 30-year fixed mortgage, typically result in lower monthly payments. This can be advantageous for individuals who prioritize affordability and want more flexibility in their budget. However, keep in mind that longer loan terms may result in paying more interest over the life of the loan.

Shorter loan terms, like a 15-year fixed mortgage, often come with higher monthly payments. However, they offer the advantage of potentially paying off the loan quicker and saving on interest payments in the long run. This option is suitable for individuals who prioritize a faster loan payoff and want to minimize the total interest paid.

Adjustable-rate mortgages, on the other hand, offer a different structure. These mortgages typically have a fixed interest rate for an initial period, often 5 or 7 years, and then switch to an adjustable rate that can fluctuate based on market conditions. While adjustable-rate mortgages can provide lower initial monthly payments, they also come with the uncertainty of potential rate increases in the future.

By using Property Finder’s Mortgage Calculator, individuals can explore different loan terms and see firsthand how they impact their monthly payment. This empowers users to make informed decisions about the loan term that aligns with their financial goals and priorities.

Example Table:

| Loan Term | Monthly Payment | Total Interest Paid |

|---|---|---|

| 30-year fixed | $1,342 | $209,697 |

| 15-year fixed | $1,895 | $68,903 |

| Adjustable-rate mortgage (5/1 ARM) | $1,274 (for the first 5 years) | $182,004 (over the life of the loan) |

This visual representation of the different loan terms and their impact on payments can help illustrate the potential differences:

Conclusion

Property Finder’s Mortgage Calculator is a valuable tool for homebuyers. By utilizing this calculator, individuals can accurately estimate their mortgage payments and effectively plan their finances. With the ability to input loan details and consider various variables, users can make informed decisions about their home purchase and gain a better understanding of their affordability.

The user-friendly interface of Property Finder’s Mortgage Calculator simplifies the process of calculating monthly payments. The comprehensive calculations take into account factors such as down payment amount, loan term, interest rate, property taxes, insurance, and additional costs. This thorough analysis provides a holistic view of the total monthly payment, enabling users to budget and allocate their funds accordingly.

Whether it’s a first-time homebuyer or someone looking for a new property, Property Finder’s Mortgage Calculator is an essential tool. It empowers users to take control of their financial planning and make well-informed decisions about their home purchase. By utilizing this calculator, individuals can confidently navigate the complex world of mortgages and secure a property that fits comfortably within their budget.

FAQ

How does Property Finder’s Mortgage Calculator work?

Why is it important to use a mortgage calculator?

What are the benefits of using Property Finder’s Mortgage Calculator?

What factors affect mortgage payments?

How do I use Property Finder’s Mortgage Calculator?

Why is it important to understand different mortgage financing options?

How does the down payment amount impact mortgage calculations?

What additional costs are included in mortgage payments?

How does Property Finder’s Mortgage Calculator calculate mortgage interest and insurance?

How do different mortgage loan terms impact payments?

Beginners Guides

Gold IRA Costs Explained – Get the Facts Now

Unlock the cost details of a gold IRA today. Learn how much does a gold ira cost with our comprehensive breakdown. Secure your future wisely!

Did you know that the cost of a gold IRA can vary significantly compared to traditional retirement accounts? Investing in physical gold as part of your retirement portfolio offers unique advantages, but it’s essential to understand the expenses involved.

A gold IRA allows you to diversify your investment portfolio by holding physical gold instead of traditional stocks and bonds. While gold IRAs offer benefits like risk reduction and protection against market volatility, it’s important to consider the costs associated with this investment option.

In this article, we’ll explore the key factors that affect the cost of a gold IRA and provide you with valuable insights to make informed decisions. Whether you’re new to retirement planning or a seasoned investor, understanding the expenses involved in a gold IRA is crucial for maximizing your financial future.

Key Takeaways:

- A gold IRA allows individuals to invest in physical gold instead of traditional stocks and bonds in their retirement accounts.

- Gold IRAs offer advantages like risk reduction, protection from market volatility, and a hedge against inflation.

- The cost of starting a gold IRA can vary depending on factors such as account setup fees, storage fees, and maintenance fees.

- Researching and comparing different gold IRA companies is essential to find the best fit for your financial goals and investment preferences.

- While there are costs involved, the long-term benefits of diversification with gold may outweigh the expenses.

What is a Gold IRA?

A Gold IRA, or individual retirement account, is a self-directed retirement account that offers individuals the opportunity to invest in physical gold and other precious metals. Unlike traditional IRAs that primarily include stocks, bonds, or mutual funds, a Gold IRA allows you to diversify your investment portfolio and protect your wealth against inflation.

In a Gold IRA, you have the option to invest in physical gold, as well as other precious metals such as silver, platinum, or palladium. These tangible assets provide a level of security and stability that is often sought after by investors looking to preserve their wealth.

One of the key requirements of a Gold IRA is that the gold or precious metals held in the account must meet specific fineness requirements. This ensures that the assets held in the IRA are of sufficient quality and value. It is important to note that not all gold or precious metals are eligible to be held in a Gold IRA, so it is crucial to understand the fineness requirements before making any investment decisions.

Once you have established a Gold IRA, your physical gold or other precious metals will be kept in custody at an approved depository. This provides a secure storage solution and ensures that your assets are protected. It is essential to choose a reputable depository that meets all industry standards and regulations.

To open a Gold IRA, you will typically need to make an initial purchase of around $100 to $300. This amount includes the costs associated with setting up the account and covers the annual administrative fees. These fees may vary depending on the specific IRA custodian or broker you choose to work with.

A Gold IRA can be an attractive option for individuals looking to diversify their retirement savings and protect their wealth against market volatility. By including physical gold and other precious metals in your investment portfolio, you can potentially mitigate risks and safeguard your financial future.

| Benefits of a Gold IRA | Requirements |

|---|---|

Investing in a Gold IRA can provide you with added financial security and peace of mind during retirement. However, it is essential to carefully consider the costs associated with setting up and maintaining a Gold IRA, as well as conducting thorough research to find a reputable custodian or broker that aligns with your financial goals and needs.

How Much Does It Cost to Start a Gold IRA?

When considering starting a gold IRA, it’s important to understand the associated costs. The initial purchase requirement for a gold IRA typically falls within the range of $100 to $300. This amount covers account setup fees and a yearly administrative fee, allowing you to establish and maintain your gold IRA.

Additionally, it’s crucial to consider purchasing fees, which may be charged by the broker or seller when acquiring the physical gold or other precious metals. These fees can vary depending on the seller and the amount of gold or precious metals being purchased.

Storage fees are another factor to consider. The Internal Revenue Service (IRS) requires that gold held in a gold IRA be stored in an approved depository. These depositories charge yearly storage fees, which typically range from $175 to $225. These fees ensure the secure and regulated storage of your gold investment.

Account maintenance fees also apply to gold IRAs. These fees cover the administration and record-keeping of your account. Annual maintenance fees for a gold IRA generally range from $80 to $300. It’s important to understand these fees and incorporate them into your overall investment strategy.

Lastly, miscellaneous fees may be incurred, such as wire transfer fees or liability insurance fees, depending on the specific terms and conditions set by the gold IRA provider. It’s essential to carefully review the fee structure of different gold IRA companies to ensure transparency and to choose the option that aligns with your investment goals.

Overall, the cost of starting a gold IRA varies based on factors such as initial purchase requirements, setup fees, storage fees, maintenance fees, and the specific gold IRA provider. By understanding these costs, you can make informed decisions regarding your retirement investment strategy and explore the potential benefits of diversifying your portfolio with gold.

Best Gold IRA Companies for Cost Transparency

Birch Gold Group is a reputable gold IRA company known for its cost transparency. The company has an A+ rating from the Better Business Bureau and offers a range of precious metal products.

Birch Gold Group charges a one-time account setup fee of $50 and annual storage and insurance fees of $100. They also have an annual management fee of $100.

Birch Gold Group guarantees that clients will never pay more than $200 in annual fees, regardless of the size of their accounts.

When it comes to investing in a gold IRA, it’s crucial to have transparent information about the associated costs. This ensures that you can make informed decisions about your retirement account. Birch Gold Group stands out as one of the best gold IRA companies in terms of cost transparency.

The company provides clear details about their fees, allowing you to understand the expenses and plan your investments accordingly. Birch Gold Group charges a one-time account setup fee of $50, which is a standard industry cost.

| Fee Type | Amount |

|---|---|

| Account Setup Fee | $50 (one-time) |

| Storage and Insurance Fees | $100 (annual) |

| Annual Management Fee | $100 |

This level of cost transparency allows you to accurately plan and budget for your gold IRA investments. Furthermore, Birch Gold Group guarantees that you’ll never pay more than $200 in annual fees, ensuring that your fees remain affordable, regardless of the size of your account.

By choosing a gold IRA company like Birch Gold Group, you can have peace of mind knowing that your investments are backed by a transparent fee structure, enabling you to make informed decisions about your retirement portfolio.

Best Gold IRA Companies for Large Deposits

When it comes to making large deposits into your gold IRA accounts, GoldCo is an excellent choice. With an A+ rating from the Better Business Bureau and high ratings from the Business Consumer Alliance, GoldCo demonstrates its commitment to customer satisfaction and trustworthiness.

GoldCo requires a minimum purchase requirement of $25,000, making it an ideal option for investors looking to deploy significant funds. Additionally, they have a minimum account balance of $25,000, ensuring that you have ample resources invested in your gold IRA.

To get started, GoldCo charges a one-time account setup fee of $50, enabling you to establish your gold IRA with ease. They also have an annual account administration fee of $80, ensuring that your investments are well-managed and secure.

When it comes to storage, GoldCo offers flexibility in selecting the type that suits your needs. The storage fees typically range from $100 to $150 per year, depending on your chosen storage option.

GoldCo At a Glance:

- Minimum Purchase Requirement: $25,000

- Minimum Account Balance: $25,000

- One-time Account Setup Fee: $50

- Annual Account Administration Fee: $80

- Storage Fees: Range from $100 to $150 per year

With GoldCo, you can confidently invest large deposits into your gold IRA, knowing that your account is in the hands of a reputable company dedicated to providing exceptional service and secure storage for your precious metals.

Why Choose GoldCo?

“GoldCo offers the perfect solution for investors looking to make substantial deposits into their gold IRA accounts. With their solid reputation and attractive fee structure, GoldCo ensures that your retirement savings are well-protected and poised for growth. Take advantage of their expertise and capitalize on the benefits of a gold IRA with large deposits.”

Don’t miss out on the opportunity to build a secure retirement account with GoldCo. Start your gold IRA journey today and enjoy the benefits of investing in physical gold with a company you can trust.

Best Gold IRA Companies for Low Purchase Requirement

Rosland Capital is a reputable gold IRA company that allows investors to start with a low purchase requirement. The company has an A+ rating from the Better Business Bureau and a AAA rating from the Business Consumer Alliance. Rosland Capital has a minimum purchase requirement of $2,000 and a minimum account balance of $2,000. They charge a one-time account setup fee of $50 and an annual maintenance fee of $100. Storage fees range from $100 to $150 per year, depending on the type of storage chosen.

If you’ve been considering investing in a gold IRA but don’t want to commit a large sum of money upfront, Rosland Capital may be the right choice for you. With a minimum purchase requirement of $2,000, you can start building your gold IRA without breaking the bank.

Rosland Capital allows investors to start small with a minimum purchase requirement of $2,000, making it accessible for those who want to dip their toes into gold investing.

Aside from their low purchase requirement, Rosland Capital is known for its excellent reputation in the industry. With high ratings from both the Better Business Bureau and the Business Consumer Alliance, you can trust that your investment is in good hands.

When you open an account with Rosland Capital, you’ll be charged a one-time account setup fee of $50. This fee covers the administrative costs associated with creating your gold IRA account.

In addition to the setup fee, Rosland Capital also charges an annual maintenance fee of $100. This fee ensures that your account is actively monitored and that you receive the necessary support and services to manage your gold IRA.

Storage fees are an important consideration when investing in a gold IRA. Rosland Capital offers various storage options, with fees ranging from $100 to $150 per year. The specific fee will depend on the type of storage you choose, such as segregated storage or secure vault storage.

With its low purchase requirement and reputable track record, Rosland Capital is an excellent choice for investors looking to start a gold IRA without a hefty initial investment.

Benefits of Choosing Rosland Capital for Your Gold IRA

- Low purchase requirement of $2,000

- A+ rating from the Better Business Bureau

- AAA rating from the Business Consumer Alliance

- One-time account setup fee of $50

- Annual maintenance fee of $100

- Storage fees ranging from $100 to $150 per year

Testimonial

“I was hesitant to invest in a gold IRA because I didn’t have a large amount of money to start. But Rosland Capital’s low purchase requirement made it possible for me to get started. I appreciate their transparency and professionalism.” – John Smith

Best Gold IRA Companies for Experienced Investors

When it comes to investing in a gold IRA, it’s essential to choose a company that caters to the needs and preferences of experienced investors. One such company is American Hartford Gold, a reputable player in the industry. With an A+ rating from the Better Business Bureau, they provide a wide range of precious metal products that can help experienced investors diversify their portfolios and protect their wealth.

To open an account with American Hartford Gold, experienced investors are required to meet a minimum purchase requirement of $10,000 as well as maintain a minimum account balance of $10,000. These barriers to entry ensure that the company caters to investors who are committed to making substantial investments in their gold IRAs.

When it comes to fees, American Hartford Gold charges an annual IRA fee of $75 for accounts valued at $100,000 or less, providing a cost-effective option for investors with smaller portfolios. For accounts valued at $100,001 or more, the annual IRA fee is set at $125, still offering competitive pricing for larger portfolios.

Storage fees for American Hartford Gold may vary depending on the chosen depository, but they typically range from $100 to $150 per year. This provides peace of mind for experienced investors, knowing that their gold is securely stored in an approved facility.

Why Choose American Hartford Gold?

- Reputable company with an A+ rating from the Better Business Bureau

- Wide range of precious metal products

- Competitive IRA fees starting at $75 per year

- Flexible storage options with fees ranging from $100 to $150 per year

For experienced investors, American Hartford Gold is a top choice for their gold IRA needs. With their commitment to customer satisfaction, array of precious metal products, and cost-effective fee structure, they provide a comprehensive solution for investors looking to diversify their portfolios with gold.

To learn more about American Hartford Gold and their offerings for experienced investors, visit their website: https://americanhartfordgold.com

Best Gold IRA Companies for Educational Resources

When it comes to investing in a gold IRA, knowledge is power. That’s why finding a gold IRA company that provides comprehensive educational resources is crucial. American Bullion is one such company that stands out in this aspect, offering a wealth of educational materials to help investors make informed decisions.

With an A+ rating from the Better Business Bureau and a AAA rating from the Business Consumer Alliance, American Bullion is a trusted name in the industry. They understand that investing in precious metals, such as gold, can be complex, especially for those new to the market.

American Bullion offers a range of investment guides and educational materials designed to empower investors with the knowledge they need to navigate the world of precious metal investing. These resources cover various topics including the benefits of a gold IRA, IRA rules and regulations, and how to diversify your retirement portfolio. Whether you’re a seasoned investor or just starting out, American Bullion has the educational resources to suit your needs.

As part of their commitment to transparency, American Bullion charges a one-time setup fee of $25. Additionally, they have an annual account fee of $160. These fees cover the administrative costs associated with managing your gold IRA and providing access to their educational resources.

“At American Bullion, we believe that education is the key to successful investing. That’s why we’ve made it our mission to provide our clients with comprehensive educational materials. We want to empower individuals to make informed decisions and take control of their retirement investments.”

By choosing a gold IRA company like American Bullion that values education, you can gain the knowledge and confidence you need to make the most of your investment. Whether you’re looking to learn the basics of precious metal investing or want to dive deeper into advanced IRA strategies, American Bullion’s educational resources can guide you on the path to financial security in retirement.

The Benefits of American Bullion’s Educational Resources

American Bullion’s educational resources provide a range of benefits for investors:

- Empowerment: Gain the knowledge and confidence to make informed investment decisions.

- Expert Insights: Access expert advice and analysis from industry professionals.

- Understanding: Learn the ins and outs of gold IRAs, retirement planning, and investment options.

- Diversification: Discover how to diversify your retirement portfolio with precious metals.

- Flexibility: Learn about different investment strategies and choose the approach that aligns with your goals.

No matter your level of experience or knowledge, American Bullion’s educational resources can provide valuable insights and guidance to help you make the most of your gold IRA investment. Take advantage of their resources and empower yourself to take control of your financial future.

Best Gold IRA Companies for Customer Service

When it comes to choosing a gold IRA company, exceptional customer service is crucial. One company that stands out in this area is Monetary Gold. With an A+ rating from the Better Business Bureau and an AAA rating from the Business Consumer Alliance, Monetary Gold has a reputation for putting customers first.

Monetary Gold goes above and beyond to provide 24/7 client assistance, ensuring that you always have access to the support you need. Whether you have questions about opening an account, purchasing gold, or managing your investments, their knowledgeable team is just a phone call or email away.

Additionally, Monetary Gold understands the importance of convenience. They offer free shipping on orders, making it easy for you to receive your precious metals securely and efficiently. As a gold IRA company committed to customer satisfaction, Monetary Gold strives to make your investment journey as seamless as possible.

| Company | BBB Rating | BCA Rating | Customer Service Highlights | Annual Storage and Insurance Fee |

|---|---|---|---|---|

| Monetary Gold | A+ | AAA | 24/7 client assistance, free shipping on orders | $100 for up to $100,000 of gold, $1 for every $1000 of gold after $100,000 |

With Monetary Gold, you can trust that your needs as a customer will be met with professionalism and dedication. Their commitment to exceptional customer service sets them apart from other gold IRA companies, making them an excellent choice for investors seeking a seamless and supportive experience.

Testimonial from a Monetary Gold Client:

“I had a fantastic experience with Monetary Gold. Their customer service team went above and beyond to assist me and answer all of my questions. They made the process of setting up my gold IRA and purchasing precious metals incredibly smooth. I highly recommend Monetary Gold for their exceptional service and commitment to their clients.” – Susan M.

Conclusion

When it comes to retirement planning, considering investment options like a gold IRA can be a smart move. Not only does it allow you to diversify your portfolio, but it also provides protection against inflation. However, before you proceed, it’s important to be aware of the costs associated with a gold IRA.

Setup fees, storage fees, maintenance fees, and other miscellaneous charges are factors you need to consider. Each gold IRA company has its own fee structure, so take the time to research and compare different options. Finding the best fit for your financial goals and investment preferences is essential.

Seeking guidance from a trusted financial advisor can help you make informed decisions about gold IRAs and their costs. They can provide valuable insights and ensure that you understand the potential benefits and drawbacks. Remember, while there may be costs involved, the long-term advantages of diversifying your retirement portfolio with gold can potentially outweigh the expenses.FAQ

What is a gold IRA?

How much does it cost to start a gold IRA?

What are the costs associated with a gold IRA?

Which gold IRA company offers cost transparency?

Which gold IRA company is best for large deposits?

Which gold IRA company has a low purchase requirement?

Which gold IRA company is best for experienced investors?

Which gold IRA company offers educational resources?

Which gold IRA company has exceptional customer service?

- About the Author

- Latest Posts

Meet Katherine, the creative enthusiast at ByRetreat who infuses her boundless passion for design into every remote workspace she crafts. With an innate sense of creativity and an eye for unconventional beauty, Katherine brings a unique and inspiring perspective to the team.

Katherine’s love for design is infectious, and her ability to think outside the box sets her apart. She believes that true artistry lies in embracing a variety of styles and mixing them harmoniously to create captivating spaces. By combining different textures, colors, and patterns, Katherine weaves a tapestry of creativity that breathes life into each remote workspace.

Beginners Guides

Erase Sharpie from Plastic: Best Methods Revealed

Did you know that permanent marker stains can be one of the most stubborn and challenging marks to remove? Especially when it comes to plastic surfaces, where the ink seems to latch on with an iron grip. But fear not! There are effective methods to erase Sharpie from plastic and restore your items to their former glory.

Key Takeaways:

- Permanent marker stains on plastic can be successfully removed with the right methods.

- Identifying the type of marker (water-based or oil-based) is crucial for determining the appropriate removal technique.

- Isopropyl alcohol and acetone are common solvents used to remove permanent marker from plastic.

- Mr. Clean Magic Eraser is an effective tool for lifting permanent marker off hard plastics.

- Always test the cleaning method on a small, inconspicuous area first and rinse thoroughly after cleaning.

Determine the Type of Marker

Before attempting to remove permanent marker from plastic, it is important to determine the type of marker used. Permanent markers can be either water-based or oil-based. Regular Sharpies are typically water-based, while Sharpie paint pens are oil-based.

To identify the type of marker, a dab of isopropyl alcohol can be applied to the marker using a cotton swab. If the pigment is picked up, it is likely a water-based marker. If not, it is an oil-based marker.

If you’re unsure whether your marker is water-based or oil-based, this simple test can help you distinguish the type before proceeding with the removal process.

Knowing the type of marker is essential as it determines the appropriate method and solvents to use for successful marker removal without damaging the plastic surface.

Removing Marker from Plastic

When it comes to removing permanent marker from plastic, there are several methods that can be effective. One of the mildest solvents to try is isopropyl alcohol. This can be easily applied using a clean, plain white paper towel. Simply soak the towel in alcohol and gently dab it on the marker stain. Then, lift up the towel to remove the ink. Isopropyl alcohol acts as a solvent, breaking down the marker pigments and making them easier to remove.

If isopropyl alcohol doesn’t do the trick, you can consider using acetone. However, it’s important to exercise caution when using acetone on plastic, as it is a stronger solvent that may potentially damage the surface. It’s always recommended to test the acetone on a discreet area first before proceeding with the full application. Apply the acetone to a clean, plain white paper towel, and gently dab it on the stain. Again, lift up the towel to remove the ink. Exercise caution and avoid prolonged contact with the plastic surface.

Another effective method for removing marker from plastic is using a Mr. Clean Magic Eraser. This versatile cleaning tool has been reported to be quite effective in lifting permanent marker off hard plastics. Simply wet the Magic Eraser and gently scrub the marker stain. The abrasive texture of the Magic Eraser helps to lift off the marker ink without damaging the plastic surface.

Comparison Table: Methods for Removing Marker from Plastic

| Method | Effectiveness | Caution |

|---|---|---|

| Isopropyl Alcohol | Effective | Minimal risk of damage, test on a discreet area first |

| Acetone | Potentially effective, but higher risk of damage | Test on a discreet area first, exercise caution |

| Mr. Clean Magic Eraser | Highly effective | Gentle scrubbing may be required |

Remember, even though these methods have been reported to be effective, it’s always a good idea to test them on a small, inconspicuous area of the plastic surface first. This helps ensure that the solvent or cleaning tool doesn’t cause any damage or discoloration. Additionally, always rinse the plastic thoroughly after cleaning to remove any residue from the cleaning solution.

With these methods and a bit of patience, you can successfully remove permanent marker stains from plastic and restore the surface to its original condition.

Removing Marker from a Whiteboard

When it comes to removing permanent marker from a whiteboard, there are a few effective methods to try. One popular option is to use rubbing alcohol or hand sanitizer, both of which contain alcohol that helps dissolve the marker ink. You can apply rubbing alcohol using a cloth or cotton ball, gently rubbing the stained area until the ink starts to lift off. Hand sanitizer can be directly applied to the marker stain, allowing the alcohol to break down the ink. Remember to use these products sparingly and avoid saturating the whiteboard.

If you’re looking for an alternative solution, here’s a surprising trick: cover the marker writing with a removable whiteboard marker. Allow it to sit for a few seconds and then erase the marks as you normally would. The solvent in the dry-erase marker helps re-solubilize the resins in the permanent inks, making it easier to remove the stain. This method can be particularly useful for older or stubborn marker stains.

Remember, always test any cleaning method on a small, inconspicuous area of the whiteboard first to ensure it doesn’t cause any damage or discoloration.

With these tried and true techniques, you’ll be able to effectively remove permanent marker from your whiteboard, leaving it clean and ready for your next brainstorming session or presentation.

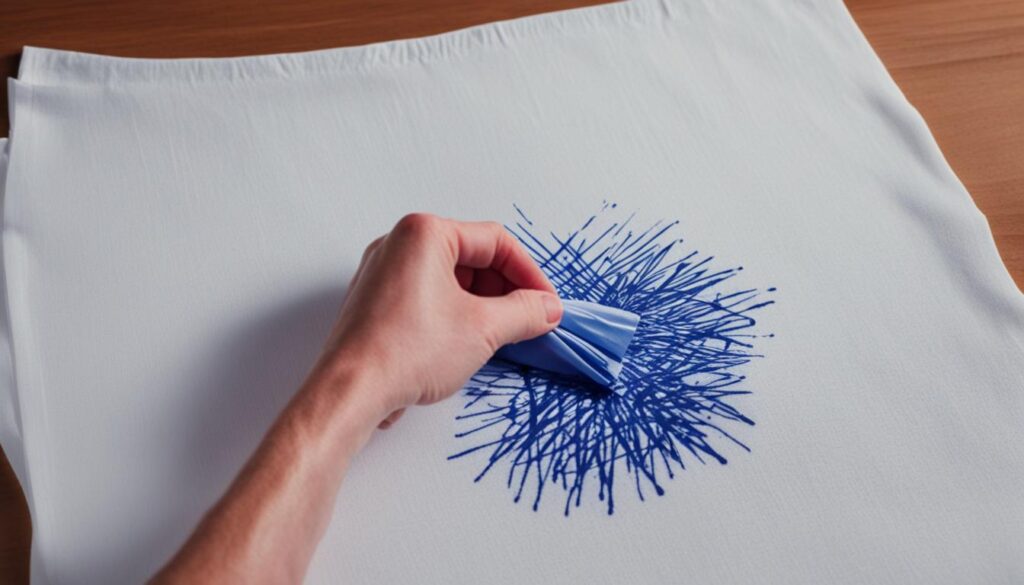

Removing Marker from Fabric

To remove permanent marker from fabric, immediate treatment is recommended. When dealing with a marker stain on fabric, it’s important to act quickly before the ink sets in. Here are some effective methods for removing marker stains from fabric:

1. Mineral Oil or Petroleum Jelly

Start by encircling the stain with mineral oil or petroleum jelly to prevent it from spreading further. This creates a barrier that hinders the ink from reaching clean areas of the fabric.

2. Isopropyl Alcohol

Using an eyedropper or cotton swab, apply isopropyl alcohol directly to the marker stain. Gently blot the stain with a clean cloth, working from the outside towards the center to avoid spreading the ink. Isopropyl alcohol acts as a solvent, breaking down the ink pigment and making it easier to remove.

3. Dishwashing Liquid

If the marker stain persists, mix a small amount of dishwashing liquid with warm water to create a soapy solution. Gently rub the solution into the stain using a clean cloth or sponge. Allow the solution to sit on the stain for at least 30 minutes, or overnight for tougher stains. Finally, rinse the fabric thoroughly with warm water to remove any remaining soap residue.

4. Amodex Ink & Stain Remover

Another effective option for removing marker stains from fabric is to use Amodex Ink & Stain Remover. This specialized product is formulated to tackle stubborn ink stains and is safe to use on a variety of fabrics. Apply a small amount of Amodex Ink & Stain Remover to the stained area and gently rub it with a brush. Rinse the fabric or launder it according to the care instructions.

Remember to always check the fabric care label before attempting any stain removal method and perform a patch test in an inconspicuous area to ensure the fabric isn’t damaged or discolored by the treatment.

| Method | Materials Needed | Steps |

|—————|———————|——————————————————————-|

| Mineral Oil or Petroleum Jelly | Mineral oil or petroleum jelly| 1. Encircle the stain with the oil or jelly.

2. Prevent the stain from spreading. |

| Isopropyl Alcohol | Isopropyl alcohol, eyedropper or cotton swab| 1. Apply alcohol to the stain.

2. Blot the stain gently.

3. Work from the outside towards the center. |

| Dishwashing Liquid | Dishwashing liquid, warm water | 1. Create a soapy solution.

2. Rub the solution into the stain.

3. Let it sit for 30 minutes to overnight.

4. Rinse the fabric thoroughly. |

| Amodex Ink & Stain Remover | Amodex Ink & Stain Remover, brush | 1. Apply Amodex to the stained area.

2. Gently rub with a brush.

3. Rinse or launder the fabric. |

These methods can help you successfully remove marker stains from fabric, allowing you to salvage your favorite garments and avoid costly replacements. Remember to act quickly, choose the appropriate method for your fabric type, and test any products or solutions in an inconspicuous area before applying them to the stain.

Removing Marker from Wood

Removing permanent marker from wood can be a bit more challenging compared to other surfaces due to its porous nature. While some marks can be easily wiped off, others may require additional steps such as light sanding or refinishing. However, before resorting to drastic measures, it’s worth trying a technique known as the “drip blot” method.

The “drip blot technique” involves applying a solvent directly onto the marker stain, allowing it to dissolve the ink, and then blotting the area with an absorbent material like a clean white paper towel or cloth. This method can be effective in removing marker stains from wood without causing damage, but it’s crucial to test the chosen solvent on an inconspicuous area first to ensure it doesn’t harm the wood’s finish.

If the marker stain is on a wooden surface that can’t be easily laundered, such as furniture or walls with semi or high gloss paint, there are a few alternative solutions to consider. Rubbing alcohol or a Magic Eraser may work on these surfaces, but it’s important to exercise caution and test these methods in a hidden area to avoid any unwanted damage.

For larger and more stubborn marker markings, using a primer before painting over the area can help conceal the writing effectively. This technique can be particularly useful when restoring wooden furniture or walls with significant marker stains, ensuring a seamless and professional finish.

| Pros of the “drip blot” technique | Cons of the “drip blot” technique |

|---|---|

|

|

Expert Tip:

When removing marker stains from wood, always start with the mildest method and gradually escalate to stronger solvents or techniques if needed. Testing on a hidden area first and exercising patience throughout the process will help protect the wood and achieve the best results.

Removing permanent marker from wood requires a delicate touch, as preserving the integrity of the wood surface is essential. By using the appropriate methods and tools, such as the “drip blot” technique, it is possible to remove marker stains and restore the natural beauty of wood items.

Other DIY Methods for Removing Marker

If the previous methods didn’t fully remove the permanent marker from plastic, there are several other DIY methods you can try. These alternative solutions can gradually fade the stains away, providing you with more options for stubborn marker removal.

Tea Tree Oil

Tea tree oil is a natural remedy known for its various cleaning properties. You can apply a few drops of tea tree oil to a cotton bud and gently rub it into the stain. Over time, the tea tree oil will gradually fade the marker away without damaging the plastic surface.

Baking Soda Paste

A baking soda paste made by mixing toothpaste and baking soda can be an effective solution for clearing off Sharpie marks on plastic. Apply the paste directly to the stain and gently scrub it in with a soft cloth or sponge. The abrasive properties of baking soda will help lift the marker, while the toothpaste adds a mild cleaning element to the mixture.

Hand Sanitizer

Hand sanitizer contains high alcohol content, making it an effective solvent for dissolving marker stains on plastic items. Simply apply a small amount of hand sanitizer to a clean cloth or sponge and rub it onto the stain until it starts to lift. The alcohol in the hand sanitizer will break down the ink, allowing it to be easily wiped away.

Hairspray

Hairspray, specifically the alcohol content in hairspray, can also be used to fade marker stains on plastic. Spray a small amount of hairspray directly onto the stain and lightly scrub it with a cloth or sponge. The alcohol in the hairspray will help dissolve the marker ink, making it easier to remove.

Stain Remover

If all else fails, you can try using a specialized stain remover designed to tackle Sharpie stains on plastic. Amodex Ink & Stain Remover is a popular choice that effectively eliminates stubborn markers. Follow the instructions on the product’s packaging and use a brush to gently rub the stain remover into the marker stain. Rinse or launder the plastic item afterward to ensure the residue is completely removed.

With these other DIY methods, you have additional options for removing permanent marker stains from plastic. Whether you choose tea tree oil, baking soda paste, hand sanitizer, hairspray, or a dedicated stain remover, you can experiment and find the solution that works best for your specific marker removal needs.

| DIY Method | Materials | Instructions |

|---|---|---|

| Tea Tree Oil | Tea tree oil, cotton bud | Apply a few drops of tea tree oil to a cotton bud and gently rub it into the stain. Repeat until the marker fades away. |

| Baking Soda Paste | Toothpaste, baking soda | Mix toothpaste and baking soda to create a paste. Apply the paste to the stain and scrub gently with a cloth or sponge. |

| Hand Sanitizer | Hand sanitizer, clean cloth or sponge | Apply a small amount of hand sanitizer to a cloth or sponge and rub it onto the stain until it starts to lift. Wipe away the ink. |

| Hairspray | Hairspray, cloth or sponge | Spray a small amount of hairspray onto the stain and lightly scrub it with a cloth or sponge. Wipe away the dissolved ink. |

| Stain Remover | Amodex Ink & Stain Remover, brush | Follow the instructions on the stain remover’s packaging. Gently rub the stain remover into the marker stain using a brush. Rinse or launder the plastic item. |

Try these DIY methods and rest assured that one of them will effectively remove the stubborn marker stains from your plastic items.

Pro Tips for Removing Marker from Plastic

When attempting to remove permanent marker from plastic, it is important to follow some pro tips to ensure successful and safe removal. These tips will help you tackle the stubborn stains effectively without damaging the plastic surface.

1. Test on Inconspicuous Area

Before applying any cleaning solution or method to remove the marker, it is crucial to test it on a small, inconspicuous area of the plastic surface. This test will determine whether the solution or method may cause discoloration or damage to the plastic. Choose an area that is hidden or less visible, and observe the results before proceeding with the full stain removal process.

2. Avoid Acetone-Based Solutions

Acetone is a strong solvent that can effectively remove permanent marker stains. However, it is highly recommended to avoid using acetone-based solutions on plastic surfaces. Acetone has the potential to make the plastic appear cloudy or even cause damage. Instead, opt for milder solvents or cleaning methods specifically designed for plastic surfaces.

3. Rinse Thoroughly

After successfully removing the marker stain, it is essential to thoroughly rinse the plastic item. This step is especially important if the plastic item comes into contact with food or if it will be used near sensitive areas. Rinse the plastic under running water or wipe it down with a clean, damp cloth to eliminate any residue from the cleaning solution. This will ensure that no traces of the cleaning solution remain on the surface and prevent any potential adverse effects.

By following these pro tips, you can confidently remove permanent marker stains from plastic surfaces, restoring their original appearance without causing any damage. Remember to test, avoid acetone-based solutions, and rinse thoroughly for optimal results.

| Pro Tips for Removing Marker from Plastic |

|---|

| Test on Inconspicuous Area |

| Avoid Acetone-Based Solutions |

| Rinse Thoroughly |

Understanding the Science Behind Marker Removal

Permanent markers use solvent-based ink, which consists of a solvent that evaporates and leaves behind the color pigment. This ink adheres firmly to the surface, making it difficult to remove. The challenge in removing marker from plastic lies in breaking down the pigment without causing damage to the plastic underneath.

The various methods mentioned earlier work by either dissolving the ink or lifting it off the surface using abrasives or solvents. By understanding the science behind marker removal, you can effectively tackle stubborn stains and restore your plastic items to their original state.

“The pigment adherence of permanent marker ink poses a unique challenge when it comes to removal. The ink’s solvent-based composition allows it to bind tightly to the surface, making it resistant to simple cleaning methods.”

When attempting to remove permanent marker, it’s important to choose a method that can break down the pigment without compromising the integrity of the plastic. Solvent-based markers require specific techniques and products to effectively remove the ink stain. By using the right combination of solvents, abrasives, and cleaning agents, you can achieve successful marker removal results.

Breaking Down the Pigment

The breaking down of the pigment involves applying a substance that can dissolve the ink or lift it off the surface. Solvent-based ink is designed to resist fading or smudging, so it requires a specialized approach.

Methods such as using isopropyl alcohol, acetone, or specialized stain removers work by dissolving the pigment, making it easier to wipe away. These substances break down the ink’s adherence to the plastic, allowing it to be lifted or dissolved during the cleaning process.

Choosing the Right Method

The effectiveness of each method will vary depending on the type and density of the permanent marker ink, as well as the type of plastic surface being treated. It’s important to remember that not all methods are suitable for all situations.

For instance, the alcohol method using isopropyl alcohol is a common and gentle approach for removing marker ink from plastic. It’s effective on most plastic surfaces and is less likely to cause damage. However, caution should be exercised when using stronger solvents such as acetone, as they can potentially damage the plastic if not used properly. Testing the cleaning solution on a small, inconspicuous area is always recommended.

The strength and durability of the plastic should also be taken into account when choosing a removal method. More delicate or porous plastics may require gentler techniques, while harder or non-porous plastics can handle stronger solvents or abrasives.

Protecting the Plastic Surface

When removing marker ink from plastic, it’s essential to protect the plastic surface from any potential damage. This can be achieved by:

- Testing the cleaning solution on a small, inconspicuous area before applying it to the entire surface.

- Using a gentle technique and gradually increasing the intensity if needed.

- Applying the cleaning solution with a soft cloth, sponge, or cotton swab to avoid scratching the plastic.

- Rinsing the plastic thoroughly after cleaning to ensure the removal of any residue.

By following these guidelines, you can safely and effectively remove marker ink from plastic surfaces without causing any harm.

Tackling Marker Stains with Patience and Care

Removing permanent marker from plastic can be a task that requires patience and the right tools. It’s important to approach the task with care and consideration for the material you’re working with. By understanding the science behind each method, you’ll be equipped with the knowledge to confidently tackle similar marker stain problems in the future.

Restoring plastic items to their former glory takes time and perseverance. Patience is key when dealing with stubborn marker stains. It may take multiple attempts and different techniques to completely remove the ink. Remember to remain patient throughout the process, working diligently to achieve the desired results.

Having the right tools is equally important. Depending on the type and intensity of the marker stain, different cleaning solvents or materials may be required. Gather the necessary supplies before starting the removal process to ensure you have everything you need.

One effective approach to restoring plastic items is by utilizing the proper cleaning methods and techniques. The combination of the right solvent and gentle scrubbing or blotting can make all the difference. By carefully following the instructions for each method and using the appropriate tools, you’ll increase your chances of successfully removing the marker stains.

Remember, restoring plastic items requires patience, the right tools, and a careful approach. Approach the task with care, ensuring you have the necessary supplies at hand. With perseverance and attention to detail, you’ll be able to remove stubborn marker stains and restore your plastic items to their original condition.

By applying these principles, you’ll be well-equipped to tackle marker stains on various plastic items. Whether it’s a beloved toy, a cherished piece of furniture, or any other plastic object, restoring them to their former glory is possible with the right approach and a little patience. Keep these tips in mind and confidently take on any marker stain challenge that comes your way.

Additional Cleaning Tips

When it comes to cleaning, there’s more than just removing permanent marker from plastic. Here are a few additional cleaning tips to help you tackle common stains and spills:

To remove stubborn rust stains from clothes and carpets, try using specific methods designed for rust stain removal. These methods may involve using commercially available rust stain removers or home remedies using ingredients like vinegar or lemon juice.

Grass stains can be notoriously tough to remove, especially from clothing. However, there are pantry staples that can come to the rescue. Try pre-treating the stain with a mix of baking soda and water or using a laundry detergent specially formulated to tackle tough stains.

Whether it’s dripping wax on a table or a candle mishap on fabric, removing candle wax can be a challenge. The key is knowing when to use cold or heat. For surfaces, freezing the wax with ice and then gently scraping it off can be effective. For fabrics, placing a paper towel over the wax and using a warm iron to melt and absorb it works well.

When it comes to paint removal from skin, scrubbing is not recommended as it can irritate the skin. Instead, try alternative methods such as using olive oil or baby oil to gently loosen the paint, followed by washing with mild soap and water.FAQ

How can I remove Sharpie from plastic?

How can I determine the type of marker used?

What are the best methods for removing marker from plastic?

How can I remove marker from a whiteboard?

What is the best way to remove marker from fabric?

How can I remove marker from wood?

Are there any other DIY methods for removing marker?

What are some pro tips for removing marker from plastic?

How does permanent marker ink work?

How should I approach removing marker stains with patience and care?

What are some additional cleaning tips?

- About the Author

- Latest Posts

Meet Katherine, the creative enthusiast at ByRetreat who infuses her boundless passion for design into every remote workspace she crafts. With an innate sense of creativity and an eye for unconventional beauty, Katherine brings a unique and inspiring perspective to the team.

Katherine’s love for design is infectious, and her ability to think outside the box sets her apart. She believes that true artistry lies in embracing a variety of styles and mixing them harmoniously to create captivating spaces. By combining different textures, colors, and patterns, Katherine weaves a tapestry of creativity that breathes life into each remote workspace.

Beginners Guides

Find Top Rated Best Moving Companies Near You

If you’re planning a move, you’re not alone. In fact, did you know that in the United States, an estimated 40 million people move each year?

Relocating can be a daunting task, but having the right moving company by your side can make all the difference. That’s why it’s essential to find the top-rated and best moving companies near you. These companies have a reputation for providing exceptional service, reliable movers, and a stress-free moving experience.

In this article, we’ve done the research for you and compiled a list of the best moving companies in your area. Whether you’re moving locally or long-distance, these top-rated movers will ensure a smooth transition and peace of mind throughout the process.

Key Takeaways:

- Over 40 million people move each year in the United States.

- Finding the best moving company can make your move stress-free and efficient.

- We’ve compiled a list of top-rated and best moving companies near you.

Top Pick: Best Overall Full-Service Mover with Worldwide Availability

This top-rated moving company is our top pick for various reasons. They offer comprehensive full-service moving solutions, making them the best choice for all your moving needs. With their worldwide availability, you can rely on their services whether you’re moving locally or long-distance.

Why Choose a Full-Service Mover?

Full-service movers handle every aspect of your move, from packing and loading to transportation and unpacking. This saves you time, energy, and stress, allowing you to focus on settling into your new home.

When you hire this best overall moving company, you can expect their experienced crew to take care of all the details, ensuring a smooth and efficient transition. Their team is trained to handle delicate items, heavy furniture, and everything in between, giving you peace of mind knowing that your belongings are in capable hands.

Additionally, this full-service mover offers binding estimates, which means the price you agree upon at the beginning will remain the same throughout the entire moving process. This eliminates any surprises or hidden fees, allowing you to plan your budget accordingly.

Worldwide moving services are another standout feature of this top-rated moving company. Whether you’re relocating within the same city or moving across the globe, their extensive network ensures that you receive reliable and efficient service no matter the destination.

Furthermore, this company understands the importance of providing top-quality service at a competitive price. They offer a price-matching policy, ensuring that you get the best value for your money.

With their commitment to customer satisfaction, comprehensive services, and worldwide availability, this best overall full-service mover is the ideal choice for your next move.

Most Experienced Mover with Binding Estimates

This highly experienced moving company stands out for its professionalism and expertise. They have a team of skilled movers who provide reliable service and ensure the safe transportation of your belongings.

When it comes to moving, trust and reliability are crucial. That’s why this company takes pride in their years of experience in the industry. With a solid track record and a team of experts, they have established themselves as one of the most experienced movers in the business.